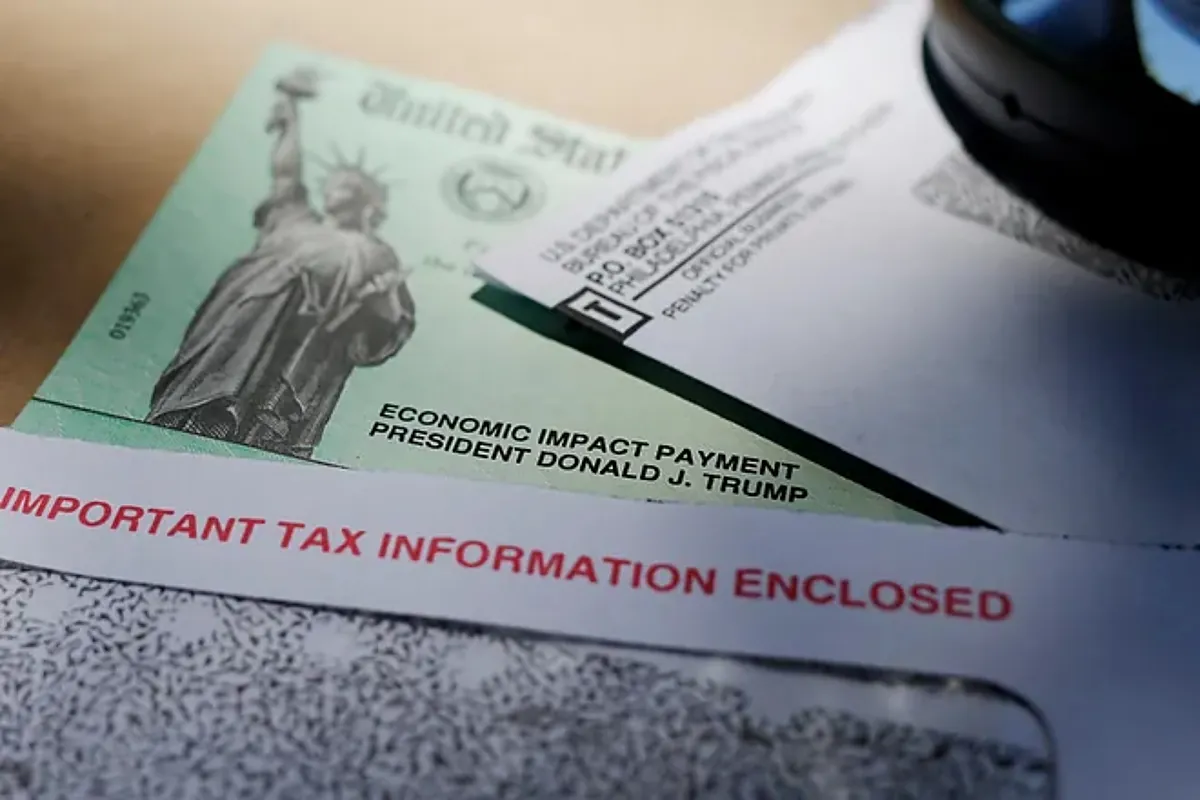

The Internal Revenue Service (IRS) determined last December to issue automatic payments to eligible taxpayers who did not claim the Recovery Rebate Credit on their 2021 tax returns

This “payment” is a recovery rebate credit for those who did not receive one or more Economic Impact Payments, or stimulus payments, issued to most Americans during the covid-19 pandemic.

Weather forecast nightmare: Driver encounters lightning strike head-on on highway

How do I know if I am eligible?

It is important to note that the check is intended for those who in their return for the year in question were eligible for it, but left the Recovery Rebate Credit field blank or filled it in with ‘$0’.

If you are aware that you did not receive one or more economic impact payments, it is also very important to make it clear that you can still apply for the Refund Credit, even if you did not file your 2021 tax return. You just have to do it before April 15.

It is therefore clear that if you received Economic Impact Payments during the covid-19 pandemic or if you have already applied for and received a check for this concept, you are no longer eligible to receive the check, whose maximum amount can reach $1,400 dollars.

How do I receive my check and what do I have to do?

Such payments are sent automatically by the IRS to all those who meet the eligibility criteria, so no action is required. If you are eligible, you will be notified by regular mail by means of a letter in which the payment and the form of payment are detailed, either by deposit or check.

Leave a Reply