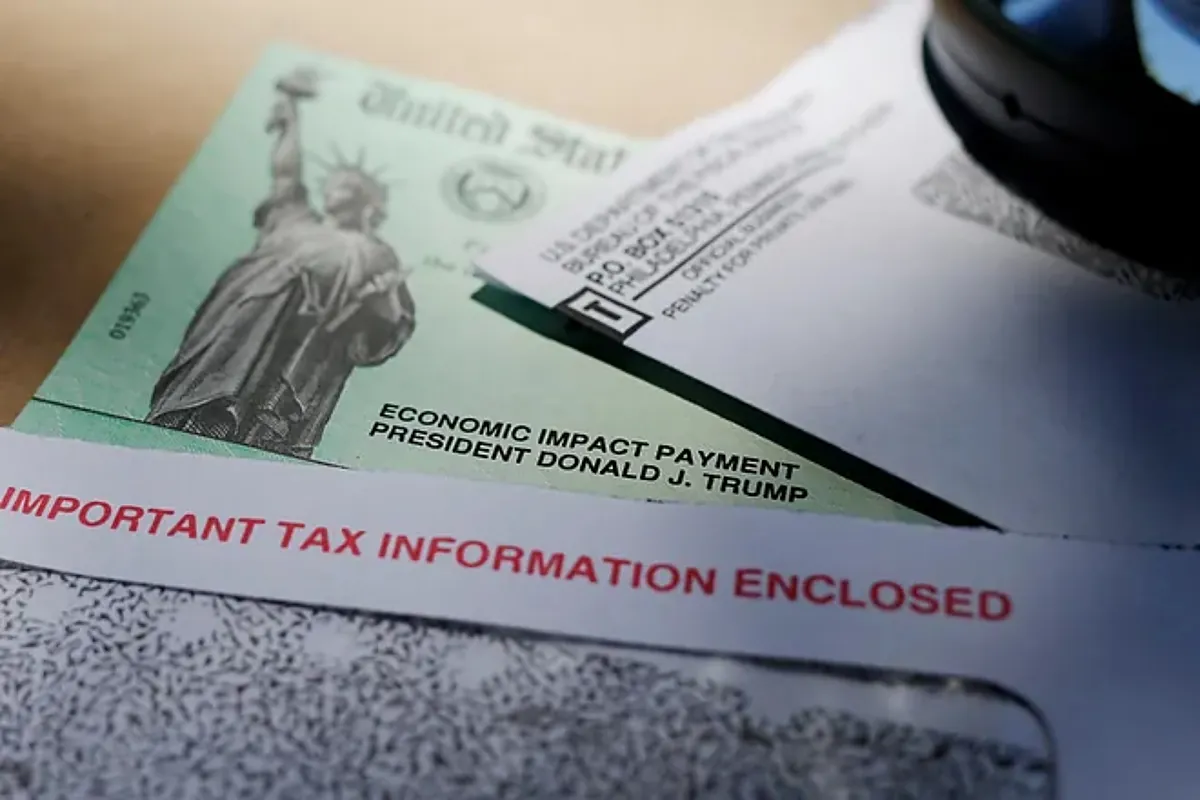

Although the U.S. government announced that some states in the U.S. will not have some form of stimulus like the one offered in 2021, there will be some taxpayers eligible to receive benefits.

Such tax benefits fall into two main categories, tax deductions and tax credits.

A tax credit is one that gives you a reduction of a dollar for the amount of tax you owe, while a tax deduction gives you a smaller benefit by allowing you a smaller amount of taxable income.

Another consideration with tax deductions is that they won’t do you much good unless you itemize your deductions, which only makes sense for people with a substantial amount of deductible expenses.

What are the tax payments you will be able to collect?

Child tax credit

The Child Tax Credit (CTC) helps families with qualifying children get a tax break.

According to the IRS, you can claim the CTC for each qualifying child who has a Social Security number and is under age 17 at the end of 2023; this year the CTC could grant you up to 2,000 dollars per child, with 1,600 dollars of the credit potentially refundable.

Child and Dependent Care Credit

You may be able to claim the child and dependent care credit if you paid child care expenses for a child under age 13, or for a spouse or parent who is unable to care for themselves.

This benefit generally allows up to 35 percent of 3,000 dollars for one dependent or 6,000 dollars for two or more dependents.

American Opportunity Tax Credit (AOC)

The American Opportunity Tax Credit (AOC), allows you to claim all of the first 2,000 dollars you spent on tuition, books, equipment and school fees, but not on living expenses or transportation, plus 25 percent of the next 2,000 dollars for a total of 2,500 dollars.

Lifetime Learning Credit

The Lifetime Learning Credit allows you to claim 20 percent of the first 10,000 dollars you paid for tuition and fees, up to a maximum of 2,000 dollars.

Like the AOC, the Lifetime Learning Credit does not count living expenses or transportation as eligible expenses. You can claim books or supplies needed for coursework.

Student loan interest deduction

The student loan interest deduction allows borrowers to write off up to 2,500 dollars of their taxable income if they paid interest on their student loans.

Adoption credit

The adoption credit is a non-refundable tax exemption that helps taxpayers cover a certain amount of qualified adoption costs per child.

The credit begins to phase out at certain income levels and is eliminated entirely once your modified adjusted gross income (MAGI) exceeds the threshold set for that tax year.

For 2023 (taxes filed in 2024), the credit is capped at 15,950 dollars.

Earned Income Tax Credit

The Earned Income Tax Credit (EITC) helps low- to moderate-income workers and families get a tax break. If you qualify, you can use the credit to reduce the taxes you owe and perhaps increase your refund.

This year’s credit ranges from 600 to 7,430 dollars, depending on how many children you have, your marital status and how much you earned.

Saver’s credit

If you make certain contributions to an employer retirement plan or an Individual Retirement Arrangement (IRA), or if you contribute to an Achieving a Better Life Experience (ABLE) account of which you are the designated beneficiary, you may be able to collect a tax. credit.

The IRS website noted that the amount of this credit can be as low as 10 percent or as high as 50 percent and is generally based on the contributions you make and your adjusted gross income.

Residential Clean Energy Credit

The Residential Clean Energy Credit is equal to 30% of the costs of a new, qualified clean energy property for your home installed anytime between 2022 and 2032.

The credit has no annual or lifetime dollar limit, except for the credit limits for fuel cell property. You can claim the annual credit each year you install eligible property until the credit begins to phase out in 2033.

Electric Vehicle Tax Credit

If you placed a new plug-in electric vehicle (EV) or fuel cell vehicle (FCV) in service this year, you may qualify for a clean vehicle tax credit.

At the time of sale, the seller must provide you with information about your vehicle’s qualifications. Dealers must also register online and report the same information to the IRS. If they fail to do so, your vehicle will not be eligible for the credit.